08251974

Sunday, December 29, 2019

Urine will tell.

Your urine can reveal a great deal about your health. Its color, density, and odor are all indications of what is going on inside your body. If you want to be able to maintain the right level of hydration and notice warning signs that may indicate a problem, you need to pay attention to your urine.

The liquid waste from your body is made up of water, chemicals like urea, and salt. The urinary tract filters and disposes of it. It passes from your kidneys through tubes (uterers) into your bladder. The bladder is like a tank for the urine. It sits there until you pee and release it through your urethra.

Saturday, December 28, 2019

Friday, December 27, 2019

Manners.

This story may not be reproduced in any manner, without the expressed permission of the author by any means available.

Wednesday, December 25, 2019

Annular Solar Eclipse.

Bukas 12262019 na magaganap ang Annular Solar Eclipse na masasaksihan sa buong bansa pero sa timog na bahagi ng bansa mas makikita ang "ring of fire" habang partial solar eclipse naman sa iba pang bahagi. #AstroPH

🌞🌝🌕🌖🌗🌒🌓🌔

Narito naman ang 10 piling syudad sa bansa na makakasaksi rin nito.

Basco, #Batanes

Starts: 12:41 pm

Maximum: 2:19 pm

Ends: 3:41 pm

About 40% will be eclipsed

Tuguegarao City, #Cagayan

Starts: 12:37 pm

Maximum: 2:19 pm

Ends: 3:45 pm

About 60% will be eclipsed

Cabanatuan City, #NuevaEcija

Starts: 12:32 pm

Maximum: 2:18 pm

Ends: 3:46 pm

About 60% will be eclipsed

Balanga City, #Bataan

Starts: 12:30 pm

Maximum: 2:17 pm

Ends: 3:46 pm

About 60% will be eclipsed

Manila City

Starts: 12:32 pm

Maximum: 2:19

Ends: 3:47

About 60% will be eclipsed

Cebu City, #Cebu

Starts: 12:39 pm

Maximum: 2:27 pm

Ends: 3:54 pm

About 80% will be eclipsed

Tagbilaran City, #Bohol

Starts: 12:39 pm

Maximum: 2:27 pm

Ends: 3:55 pm

About 80% will be eclipsed

Malaybalay City, #Bukidnon

Starts: 12:43 pm

Maximum: 2:30 pm

Ends: 3:56 pm

About 85% will be eclipsed

Davao City

Starts: 12:44 pm

Maximum: 2:30 pm

Ends: 3:57 pm

About 90% will be eclipsed (ring of fire)

Maasim City, #Saranggani

Starts: 12:42 pm

Maximum: 2:29 pm

Ends: 3:57 pm

About 95% will be eclipsed (ring of fire)

🌞🌝🌕🌖🌗🌒🌓🌔

Narito naman ang 10 piling syudad sa bansa na makakasaksi rin nito.

Basco, #Batanes

Starts: 12:41 pm

Maximum: 2:19 pm

Ends: 3:41 pm

About 40% will be eclipsed

Tuguegarao City, #Cagayan

Starts: 12:37 pm

Maximum: 2:19 pm

Ends: 3:45 pm

About 60% will be eclipsed

Cabanatuan City, #NuevaEcija

Starts: 12:32 pm

Maximum: 2:18 pm

Ends: 3:46 pm

About 60% will be eclipsed

Balanga City, #Bataan

Starts: 12:30 pm

Maximum: 2:17 pm

Ends: 3:46 pm

About 60% will be eclipsed

Manila City

Starts: 12:32 pm

Maximum: 2:19

Ends: 3:47

About 60% will be eclipsed

Cebu City, #Cebu

Starts: 12:39 pm

Maximum: 2:27 pm

Ends: 3:54 pm

About 80% will be eclipsed

Tagbilaran City, #Bohol

Starts: 12:39 pm

Maximum: 2:27 pm

Ends: 3:55 pm

About 80% will be eclipsed

Malaybalay City, #Bukidnon

Starts: 12:43 pm

Maximum: 2:30 pm

Ends: 3:56 pm

About 85% will be eclipsed

Davao City

Starts: 12:44 pm

Maximum: 2:30 pm

Ends: 3:57 pm

About 90% will be eclipsed (ring of fire)

Maasim City, #Saranggani

Starts: 12:42 pm

Maximum: 2:29 pm

Ends: 3:57 pm

About 95% will be eclipsed (ring of fire)

Tuesday, December 24, 2019

Gulay

GULAY: PAMPAHABA NG BUHAY - Napaka-Sustansya !

Ni Doc Willie Ong (SHARE po with friends. Sa mga ayaw kumain ng gulay!)

Kaibigan, kapag kumakain ako ng gulay, pakiramdam ko ay umiinom na rin ako ng tableta ng vitamins, minerals, fiber at anti-oxidants. Ito'y dahil sa mga masustansyang sangkap ng gulay.

1. Ang sobrang pagkain ng karne ng baboy at baka ay pinapaniwalaang nakakapagdulot ng cancer, tulad ng breast cancer.

2. Ang pagkain ng gulay ay nakatutulong sa pag-iwas sa Kanser.

3. Ang gulay ay makatutulong sa pagbaba ng cholesterol, pag normal ng pagdumi at pag-iwas sa diabetes at sakit sa puso.

4. Hindi bawal ang pagkain ng gulay sa anumang sakit. Puwede ito sa may high blood, goiter, arthritis, sa buntis at sa bata. Sa katunayan, may tulong ito sa maraming sakit.

5. Ugaliing kumain ng 2 tasang gulay araw-araw para sa iyo at iyong pamilya.

Anong gulay ang paborito mo? Comment below. Kung wala sa listahan, add your favorite gulay.

1) Okra

2) Pechay

3) Malunggay

4) Carrots

5) Patola

6) Baguio Beans

7) Cabbages

8) Spinach

9) Broccoli

10) Monggo Beans

11) Kangkong

12) Shitake mushrooms

Ni Doc Willie Ong (SHARE po with friends. Sa mga ayaw kumain ng gulay!)

Kaibigan, kapag kumakain ako ng gulay, pakiramdam ko ay umiinom na rin ako ng tableta ng vitamins, minerals, fiber at anti-oxidants. Ito'y dahil sa mga masustansyang sangkap ng gulay.

1. Ang sobrang pagkain ng karne ng baboy at baka ay pinapaniwalaang nakakapagdulot ng cancer, tulad ng breast cancer.

2. Ang pagkain ng gulay ay nakatutulong sa pag-iwas sa Kanser.

3. Ang gulay ay makatutulong sa pagbaba ng cholesterol, pag normal ng pagdumi at pag-iwas sa diabetes at sakit sa puso.

4. Hindi bawal ang pagkain ng gulay sa anumang sakit. Puwede ito sa may high blood, goiter, arthritis, sa buntis at sa bata. Sa katunayan, may tulong ito sa maraming sakit.

5. Ugaliing kumain ng 2 tasang gulay araw-araw para sa iyo at iyong pamilya.

Anong gulay ang paborito mo? Comment below. Kung wala sa listahan, add your favorite gulay.

1) Okra

2) Pechay

3) Malunggay

4) Carrots

5) Patola

6) Baguio Beans

7) Cabbages

8) Spinach

9) Broccoli

10) Monggo Beans

11) Kangkong

12) Shitake mushrooms

Saturday, December 21, 2019

Thursday, December 19, 2019

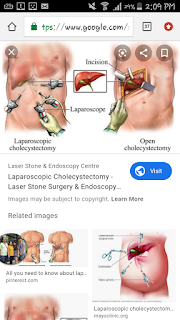

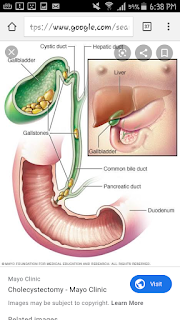

Sintomas ng bato sa apdo at gallstone.

Alamin ang Sintomas ng Bato sa Apdo o Gallstone

Payo ni Doc Willie Ong at Doktor Doktor Lads

Ang gallstones o bato sa apdo ay mga namuong deposits ng digestive fluid sa gall bladder. Ang gall bladder ay maliit na organ sa kanang bahagi ng tiyan sa ilalim ng atay. Ito ang nagsisilbing imbakan ng bile na kailangan para sa pagtunaw ng taba sa ating bituka.

Iba iba ang laki ng gall stones. Maaaring kasinlaki lang iton ng butil ng buhangin at maaari itong maging kasinlaki ng isang golf ball. Ang mga taong may gallstones at nakakaranas ng mga sintomas ay kadalasang kinakailangang sumailalim sa operasyon upang tanggaling ang apdo. Ngunit kung wala namang senyales at sintomas na nararamdaman ay hindi ito kailangang operahan.

Sintomas ng Gall Stones

Minsan ay walang sintomas na nararamdaman ang may mga gallstones. Ngunit kapag bumara ang gallstones sa mga ducts sa apdo ay maaari itong magdulot ng sintomas tulad ng:

1. Biglaan at matinding sakit sa itaas na kanang bahagi ng tiyan,

2. Matinding sakit sa gitnang bahagi ng tiyan sa ilalim ng breastbone

3. Pananakit ng likod at kanang balikat

4. Ang sakit na ito ay maaaring maramdaman sa loob ng ilang minuto hanggang ilang oras.

Kapag naramadaman ang mga sintomas na ito, kumonsulta sa inyong doktor.

Payo ni Doc Willie Ong at Doktor Doktor Lads

Ang gallstones o bato sa apdo ay mga namuong deposits ng digestive fluid sa gall bladder. Ang gall bladder ay maliit na organ sa kanang bahagi ng tiyan sa ilalim ng atay. Ito ang nagsisilbing imbakan ng bile na kailangan para sa pagtunaw ng taba sa ating bituka.

Iba iba ang laki ng gall stones. Maaaring kasinlaki lang iton ng butil ng buhangin at maaari itong maging kasinlaki ng isang golf ball. Ang mga taong may gallstones at nakakaranas ng mga sintomas ay kadalasang kinakailangang sumailalim sa operasyon upang tanggaling ang apdo. Ngunit kung wala namang senyales at sintomas na nararamdaman ay hindi ito kailangang operahan.

Sintomas ng Gall Stones

Minsan ay walang sintomas na nararamdaman ang may mga gallstones. Ngunit kapag bumara ang gallstones sa mga ducts sa apdo ay maaari itong magdulot ng sintomas tulad ng:

1. Biglaan at matinding sakit sa itaas na kanang bahagi ng tiyan,

2. Matinding sakit sa gitnang bahagi ng tiyan sa ilalim ng breastbone

3. Pananakit ng likod at kanang balikat

4. Ang sakit na ito ay maaaring maramdaman sa loob ng ilang minuto hanggang ilang oras.

Kapag naramadaman ang mga sintomas na ito, kumonsulta sa inyong doktor.

Tuesday, December 17, 2019

Si nanay.

Eksaktong nasa Or. Mindoro ako nung mag-landfall ang bagyong Tisoy. Kinabukasan, na-survey ko ang kahabaan ng hilagang Mindoro mula Calapan hanggang Pto. Galera.

Parang tinabas ang mga punong saging. Meron ding mangilan-ngilang punongkahoy ang natumba: mangga, kaimito at acacia. Napansin kong merong pagkakahawig ang mga punong ito. Lahat sila mababaw ang ugat. Kaya madaling mabuwal.

Ganun din sa buhay.

Noong nabubuhay pa sila, parehong madasalin, masipag at maasikasong magulang ang aking ama at ina. Isa itong espesyal na biyaya na habambuhay, ipagpapasalamat naming magkakapatid sa Diyos.

Si Tatay ang kinamulatan naming “batas” sa tahanan dahil sa paraan ng kanyang pagdisiplina. Pero napansin ko na pag tila sinasalpok kami ng malalaking alon ng mga problema na yumayanig sa pamilya, si Nanay ang siyang nagtitimon ng bangka.

‘Yung Tatay ko na beteranong sundalo at sumabak sa World War 2 at Korean War, madaling mataranta, mabilis panghinaan ng loob. Pero si Nanay, kahit mababaw ang luha, malalim ang pundasyon.

Siya ang may kalmadong disposisyon at malinaw magdesisyon. Kaya siya rin ang laging nakakatagpo ng tamang solusyon. Parang ilog na tahimik na umaagos pero di mo akalaing malalim.

Parang Pasko rin. Pwedeng makulay, makislap at maingay pero hindi nangangahulugang makahulugan. Pamilyar ka na siguro sa ganung feeling. September pa lang excited ka na. Pinagplanuhan mo at ginastusan ang dekorasyon, handa at mga ireregalo. Sa dami ng inasikaso, puyat, ka, pagod at aburido. Pagsapit ng Pasko, gusto mo na lang matulog!

Magandang tradisyon ang pagpapalitan ng regalo pero nakakalungkot na ang diwa ng bahaginan, tila nilamon na ng konsumerismo at materyalismo. Subukan mong alalahanin ang mga Paskong nagdaan at tukuyin mo alin ang pinaka-meaningful. Makikita mong wala ito sa dami ng handa. O sa bonggang dekorasyon. O sa laki o bigat ng regalo.

Ang pinakamasasaya at di-malilimutang Pasko, nasa lalim ng pagmamahal na nadama mo sa puso. Nasa lalim ng pasasalamat mo sa Diyos na kailanman, di ka iniwan. Nasa lalim ng ugnayan ng mag-asawa, magkasintahan, magkapatid at magkaibigan. Nasa lalim ng karanasang magkakasamang pinagdiwang ng pamilya, barkada o community.

Ang totoo, lahat tayo, may kakayahang lumalim. Bilang mga anak ng Diyos, likas sa atin ang pagiging malalim. Kung sa panahon ng pagsubok ay madali tayong matumba gaya ng punong mababaw ang ugat, ‘yun ay dahil huminto tayo sa paglalim.

Huminto tayo noong humanga tayo sa marami, malaki at matayog. Huminto tayo noong nalibang tayo ng masarap, makislap at maingay. Huminto tayong lumalim noong huminto tayong mamuhunan sa pagmamahal.

Ilang araw na lang, Pasko na. Ang wish ko para sa ‘yo at sa mga mahal mo—isang malalim na Pasko!

Parang tinabas ang mga punong saging. Meron ding mangilan-ngilang punongkahoy ang natumba: mangga, kaimito at acacia. Napansin kong merong pagkakahawig ang mga punong ito. Lahat sila mababaw ang ugat. Kaya madaling mabuwal.

Ganun din sa buhay.

Noong nabubuhay pa sila, parehong madasalin, masipag at maasikasong magulang ang aking ama at ina. Isa itong espesyal na biyaya na habambuhay, ipagpapasalamat naming magkakapatid sa Diyos.

Si Tatay ang kinamulatan naming “batas” sa tahanan dahil sa paraan ng kanyang pagdisiplina. Pero napansin ko na pag tila sinasalpok kami ng malalaking alon ng mga problema na yumayanig sa pamilya, si Nanay ang siyang nagtitimon ng bangka.

‘Yung Tatay ko na beteranong sundalo at sumabak sa World War 2 at Korean War, madaling mataranta, mabilis panghinaan ng loob. Pero si Nanay, kahit mababaw ang luha, malalim ang pundasyon.

Siya ang may kalmadong disposisyon at malinaw magdesisyon. Kaya siya rin ang laging nakakatagpo ng tamang solusyon. Parang ilog na tahimik na umaagos pero di mo akalaing malalim.

Parang Pasko rin. Pwedeng makulay, makislap at maingay pero hindi nangangahulugang makahulugan. Pamilyar ka na siguro sa ganung feeling. September pa lang excited ka na. Pinagplanuhan mo at ginastusan ang dekorasyon, handa at mga ireregalo. Sa dami ng inasikaso, puyat, ka, pagod at aburido. Pagsapit ng Pasko, gusto mo na lang matulog!

Magandang tradisyon ang pagpapalitan ng regalo pero nakakalungkot na ang diwa ng bahaginan, tila nilamon na ng konsumerismo at materyalismo. Subukan mong alalahanin ang mga Paskong nagdaan at tukuyin mo alin ang pinaka-meaningful. Makikita mong wala ito sa dami ng handa. O sa bonggang dekorasyon. O sa laki o bigat ng regalo.

Ang pinakamasasaya at di-malilimutang Pasko, nasa lalim ng pagmamahal na nadama mo sa puso. Nasa lalim ng pasasalamat mo sa Diyos na kailanman, di ka iniwan. Nasa lalim ng ugnayan ng mag-asawa, magkasintahan, magkapatid at magkaibigan. Nasa lalim ng karanasang magkakasamang pinagdiwang ng pamilya, barkada o community.

Ang totoo, lahat tayo, may kakayahang lumalim. Bilang mga anak ng Diyos, likas sa atin ang pagiging malalim. Kung sa panahon ng pagsubok ay madali tayong matumba gaya ng punong mababaw ang ugat, ‘yun ay dahil huminto tayo sa paglalim.

Huminto tayo noong humanga tayo sa marami, malaki at matayog. Huminto tayo noong nalibang tayo ng masarap, makislap at maingay. Huminto tayong lumalim noong huminto tayong mamuhunan sa pagmamahal.

Ilang araw na lang, Pasko na. Ang wish ko para sa ‘yo at sa mga mahal mo—isang malalim na Pasko!

Monday, December 16, 2019

Confine at

12/18/19

7:20. Dr Ronald Romero gastroenterology visit okay na yung endoscopy may 3 bato na nakuha. Kay Dra Janeth Carreon surgeon na laparoscopy.

9:12 still Fely is in OR.

10:04 still Fely is in OR

11:00 still Fely is in OR. No update yet. Praying everything is fine.

12:10 Update di nakaya sa laparoscopy bulok na yung gall bladder ni Fely. Need hiwain para matanggal ang gall bladder at matakpan yung tube. As per discussion with Dra Carreon and Dra Amellie Manahan anesthesiology. Okay naman si Fely.

1:15pm pinatawag ni Dra carreon at Dra Manahan pinakita yung bato at supot ng gall bladder ni mama Fely. OMG daming bato maliliit at malalaki at over large yung gall bladder nya.

After surgery and recovery. Bring back to her room 334 rate Php2457.00 at around 5:45pm.

Karen visit her mama and go home around 6:30pm.

12/19/19

Still groge and in pain. Ateng Flor arrived around 11am since in force leave siya muna magbabantay kay Fely. Coz I will go to work for 2 nights we have company shutdown.

12nn Fely was visited by her doctor Dra Carreon. Ask her to sit inhale exhale and do foot movement.

7pm she was visited by Insan Dina, Bert, and Rheena.

12/20/19

2am She feel pain in the surgery. Inject buscopan.

4am nurse on duty inject another pain reliever.

5am Fely was able to sleep.

12212019 up to 12222019 - she was able to walk and atand with the help of her ate Flor. Naka utot na din sya.

12232019 - Monday

Visit Mama Fely at Perpertual Help Medical Center.

17+18+18+254+11

Around 8am Ateng Flor go home. Thank you sa pag aalaga.

2:25 already give to philhealth requirement for billing.

Now were waiting for final bill less HMO and Philhealth.

Total bill = Php 360,231.27

Less Philhealth Rm & lab = Php 18,600.00

Philhealth doctor p.f. = Php 12,400.00

Less HMO etiqa = Php 190,000.00

Cashout hospital bill = Php 329,231.27

12252019 around 2pm nakadumi na si Fely praise God.

12262019 around 6pm nakadumi uli.

12272019 she was visited by annie irene rose glo and gemsy.

01042020 Follow-up check at perpetual to Dra Carreon - Rm 613 surgeon MTWTS 8am to 10am. Remove JP drain and staple.

Grab - php175.00Burger king - php247.00

PF - php1000.00

Mami - php50.00

Clinical Abstract - php70.00

Discharge summary - php70.00

Operative Technique - php70.00

Grab - php215 + 5 tip.

Next check-up Feb 3, 2020. For check up with Dr. Ronald Romero - gastroenterology IM - Room 503 MWF 11 to 12am.

01062020 - Makirot pa rin ang sugat. Nakadumi sya matigas around 7pm. She should eat apple and grapes.

01102020 - nakadumi uli sya malaki matigas.

Sunday, December 15, 2019

Toyota promo

12/16/19

Battery was check and still okay.

2017 to 2018 = 2017

2018 to 2019 = 2018

2019 to 2020 = 2019 - 3rd year

2020 parehistro kana.

12/2017

12/2018

12/2019 - 3rd year.

Lto

Lto 12/12/2019

Sticker print out 2017 - 2020

Sticker print out 2017 - 2020

Next registration MARCH 2021.

Registered 6/19/19 - next registration 6/19/20.

Saturday, December 14, 2019

Question

Did you inherit real estate property but you cannot transfer it under your name because of unpaid taxes?

Avail now of the Estate Tax Amnesty in the Philippines!

Mga Benepisyo (Benefits):

- 6% tax lang ang babayaran ! (You will only pay 6% )

- Walang babayarang back taxes at penalties (You will not pay back taxes and penalties.)

- Absuwelto pa sa demanda!

Republic Act No. 11213 (RA 11213) or the Tax Amnesty Act aims “to provide the taxpayers a one-time opportunity to settle estate tax obligations through an estate tax amnesty program that will give reasonable tax relief to estates with outstanding estate tax liabilities.”

June 15, 2019 and, is the start of the two-year period provided for by Republic Act 11213 (RA 11213) or the “Tax Amnesty Act” within which the taxpayers can avail themselves of the benefits of the Estate Tax Amnesty law. I wrote the basics of the Estate Tax Amnesty Act here but for a more detailed clarification on issues, here are 40 Frequently Asked Questions on the Estate Tax Amnesty 2019 in the Philippines.

Q1: Who is qualified to avail of the estate tax amnesty under RA No. 11213?

A1:The estate of the decedent who died on or before December 31, 2017, who is not covered by the exceptions enumerated under Sec. 3 of RR No. 6-2019 dated May 29,2019, is qualified to avail of tax amnesty.

Q2: Who shall file the estate tax amnesty?

A2: The executor or administrator, legal heirs, transferees or beneficiaries (or filer) shall file the estate tax amnesty return within two (2) years from the effectivity of RR No. 6-2019 or from June 15, 2019 to June 14, 2021.

Q3: Will a Taxpayer Identification Number (TIN) be issued for the estate of the decedent?

A3: Yes, if there is no existing TIN.

Q4: Are all heirs required to secure their own TIN?

A4: Yes, all heirs, including minors without TIN are required to secure their respective TIN.

Q5: What BIR form will be used in the filing and payment of estate tax amnesty?

A5: BIR Form No. 2118-EA – Estate Tax Amnesty Return (ETAR) and BIR Form No. 0621-EA – Acceptance Payment Form Estate Tax Amnesty (APF), duly endorsed for payment by the concerned Revenue District Officer, shall be used in filing and payment of estate tax amnesty.

Q6: When and where will the ETAR be filed?

A6: The ETAR shall be filed with the Revenue District Office (RDO) having jurisdiction over the last residence of the decedent, within two (2) years from the effectivity of RR No. 6-2019 or from June 15, 2019 to June 14, 2021. In case the estate has a previously issued TIN, the ETAR shall be filed with the RDO which issued the said TIN.

For non-resident decedent, the executor or administrator in the Philippines, shall file the return with the RDO where such executor/administrator is registered or if not yet registered, at the RDO having jurisdiction over the legal residence of the executor/administrator. If there is no executor or administrator, the return shall be filed with RDO No. 39-South Quezon City.

If the properties involved are common properties of multiple decedents emanating from the first decedent, and no estate tax returns have been previously filed, the amnesty tax returns for every stage of transfer/succession may be filed together in any one (1) RDO having jurisdiction over the last residence of any of the decedents.

Illustration:

How to file estate of decedents involving several stages of succession from a common property left by the first decedent

| Stage of Succession | Property | Decedent | Date of Death | Last Residence | Where to file |

|---|---|---|---|---|---|

| 1st | TCT No. 12345 | Alpha | Dec. 31, 1985 | Caloocan City | All four (4) ETARS may be filed in any of the RDOs covering the last residence of any of the decedent |

| 2nd | TCT No. 12345 | Bravo (heir of Alpha) | July 27, 1992 | Cabanatuan City, Nueva Ecija | All four (4) ETARS may be filed in any of the RDOs covering the last residence of any of the decedent |

| 3rd | TCT No. 12345 | Charlie (heir of Bravo) | Dec. 31, 1997 | Calbayog City,Samar | All four (4) ETARS may be filed in any of the RDOs covering the last residence of any of the decedent |

| 4th | TCT No. 12345 | Delta (heir of Charlie) | Dec. 31, 2017 | Tagum City, Davao Del Norte | All four (4) ETARS may be filed in any of the RDOs covering the last residence of any of the decedent |

Q7: Where will the ETAR be filed if the estate has a previously issued TIN?

A7: The ETAR shall be filed with the RDO which issued the said TIN

Q8: How many ETAR shall be filed?

A8: One (1) ETAR in triplicate copies shall be filed for the estate of every decedent.

- Original – Document Processing Division (DPD)

- Duplicate – Docket File

- Triplicate – Taxpayer’s Copy

Q9: Can the estate tax amnesty application be filed through eBIR facility?

A9: No. The forms are downloadable from the BIR website and are not available in eBIRForms. Hence, the filing and payment of estate tax amnesty shall be done manually.

Q10: How many Extra Judicial Settlement (EJS) shall be submitted in case the estate

involves multiple decedents?

A10: One (1) EJS for every stage of transfer/succession or one (1) EJS covering all the stages of transfer/succession with respect to the inherited share of the common property/ies emanating from the first decedent shall be submitted.

Q11: When no zonal valuation is available at the time of death, what will be used as reference for

purposes of valuation of properties?

A11: The Fair Market Value (FMV) appearing in the tax declaration issued at the date of death or the succeeding available tax declaration issued nearest to the date of death shall be used as reference in computing the value of the property at the time of death.

Q12: Will the filer be required to submit certificate of zonal valuation from the RDO

where the property is located?

A12: No. Verification of zonal values can be made thru the BIR website.

Q13: If there is no tax declaration available at the time of death, what will be used as

basis to comply with the requirement?

A13: The succeeding available tax declaration issued nearest to the date of death shall be used as reference.

Q14: What will be the estate tax amnesty rate? Is there a minimum amount to be paid to

avail of the estate tax amnesty?

A14: A rate of six percent (6%) based on the decedent’s total net taxable estate at the time of death shall be imposed at every stage of succession. The minimum amount is Five Thousand Pesos (P5,000.00).

Q15: What is the basis in computing the estate tax amnesty due on undeclared properties

for the previously filed estate tax return?

A15: An estate tax amnesty rate of six percent (6%) shall be imposed on the value of the undeclared properties at the time of death, without deductions which are deemed to have been claimed in the previous estate tax return filed, except for the share of the surviving spouse on the undeclared conjugal property. However, in no case shall the payment be lower than Five Thousand Pesos (P5,000.00).

Example No. 1. Mr. X died on June 30, 2017. After filing the estate tax return under BIR Form 1801 on November 15, 2017, the heirs discovered that a conjugal real property with FMV of P3,000,000.00 was not included in the gross estate declared.

Since there is an estate tax return previously filed, an estate amnesty amount of P90,000.00, after deducting the share of surviving spouse, shall be computed as follows:

| FMV of the property | 3,000,000.00 |

|---|---|

| Less: Share of surviving spouse | 1,500,000.00 |

| Net undeclared property | 1,500,000.00 |

| Multipy by | 6% |

| Estate Tax Amnesty Amount Due | 90,000.00 |

Example No. 2. Mr. X died on June 30, 2017. Since no estate tax return has been previously filed, the heirs availed of the estate tax amnesty on June 26, 2019. After a few months, the heirs discovered that a conjugal real property with FM of P3,000,00.00 was not included in the gross estate declared.

Since there is an ETAR previously filed, the amount of P90,000.00, after deducting the share of surviving spouse, shall be computed as follows:

| FMV of the property | 3,000,000.00 |

|---|---|

| Less: Share of surviving spouse | 1,500,000.00 |

| Net undeclared property | 1,500,000.00 |

| Multipy by | 6% |

| Estate Tax Amnesty Amount Due | 90,000.00 |

Q16: Can the filer still avail of the estate tax amnesty for undeclared property if the estate

has an existing estate tax delinquency?

A16: Yes, provided that the undeclared property is not included in the list of properties covered in the existing estate tax delinquency. Further, the ETAR shall be filed in the RDO that issued the assessment.

Q17: The basic estate tax due of a decedent who died on December 31, 2017 was voluntarily

paid on August 15, 2018, but the taxpayer failed to pay the corresponding penalties.

Can the taxpayer avail of the estate tax amnesty on the unpaid penalties?

A17: Yes, by paying the minimum estate tax amnesty amount of Five Thousand Pesos (P5,000.00) and filing the required ETAR.

Q18: When will the APF be approved and endorsed for payment by the Revenue District Officer?

A18: The APF shall be approved and endorsed by the Revenue District Officer for payment after the pre-evaluation of the complete documentary requirements submitted by the filer and upon computation of the estate tax amnesty due.

Q19: Where will the estate tax amnesty be paid and what document shall be presented

for payment?

A19: Payment shall be made to any Authorized Agent Bank (AAB) under the jurisdiction of the concerned RDO by presenting the duly endorsed APF.

However, payment may be made to the Revenue Collection Officer (RCO) under the following instances:

- In case of cash payment and the amount involved is Twenty Thousand Pesos (P20,000.00) and below; and

- If the payment is through manager’s/cashier’s check, irrespective of amount.

If there is no AAB in the RDO, payment shall be made to the RCO subject to the conditions in”1″ and “2” above.

Q20: Will the BIR allow a partial or total withdrawal of cash in bank for payment

of estate tax amnesty?

A20: The Commissioner or the Revenue District Officer may, upon written request of the taxpayer, issue a letter allowing partial or total withdrawal of the cash equivalent to the estate tax amnesty due without subjecting to the final withholding tax.

The form of payment to be issued by the bank should be a manger’s/cashier’s check which shall indicate in the space provided for “PAY TO THE ORDER OF”:

- presenting/collecting bank or the bank where the payment is to be coursed and

- FAO (For the Account of) Bureau of Internal Revenue as payee.

Q21: Can the estate tax amnesty be paid in installment?

A21: No. For purposes of estate tax amnesty, installment payment is not allowed.

Q22: Do we compute both estate and inheritance taxes in case the decedent died at

the time when there were estate and inheritance taxes imposed?

A22: No. The estate tax amnesty rate of six percent (6%), which shall cover both the unpaid estate and inheritance taxes, shall be computed based on the net taxable estate.

Q23: What are the deductions to be applied in the computation of net taxable estate?

A23: The deductions to be applied in the estate tax amnesty shall be based on the estate tax law prevailing at the time of death.

Click to view Allowable Deductions from the Gross EstateQ24: Can the estate involving judicial settlement/last will of testament pending in court

avail the estate tax amnesty?

A24: Yes, provided that the filer shall submit a certified true copy of the court resolution or leave of court together with all the documentary requirements for estate tax amnesty within the two-year availment period. However, only the CA shall be issued on the filer.

The ONETT Team of the RDO who will prepare the CA shall encode the details of the property/ies listed in the inventory of properties/last will of testament pending in court on the lower portion of the CA after the caveat or at the back of the CA.

Q25: In relation to Q24, when will the electronic Certificate Authorizing Registration

(eCAR) be issued?

A25: The eCAR shall be issued upon presentation of the final order of the court.

Q26: If there is an on-going expropriation case on the property, can the taxpayer avail

of the estate tax amnesty?

A26: Yes. If the expropriation happened after the death of the decedent, the expropriated property will form part of the gross estate of the decedent and can avail of the amnesty. However, if the expropriation happened during the lifetime of the decedent, the expropriated property will not form part of the gross estate of the decedent.

Q27: In case of multiple succession, how will the names of the estates and corresponding

heirs be presented on the eCAR?

A27: All the names of the decedents as stated on EJS or Judicial Settlement, as the case may be, will be shown on the eCAR. A brief explanation as to consolidation of the estates and the corresponding payment for all estates must be clearly stated on the “Remarks” and “Payment Details” fields, of the eCAR, respectively.

Q28: How many eCARS shall be issued for a real property covered by one (1) Title

involving multiple succession?

A28: One (1) eCAR only will be issued per real property, including the improvements, if any, provided that the eTARS are filed simultaneously at only one (1) RDO.

Q29: Is delinquent estate tax liability covered on the RR on Estate Tax Amnesty?

A29: No. It is covered by Sec. 3 of RR No. 4-2019 on tax amnesty on delinquencies, quoted hereunder:

“SECTION 3. COVERAGE. All persons, whether, natural or juridical, with internal revenue tax liabilities covering taxable year 2017 and prior years, may avail of Tax Amnesty on Delinquencies within one (1) year from the effectivity of these Regulations, under any of the following instances:

A. Delinquent Accounts as of the effectivity of these Regulations, including the following:

- Delinquent Accounts with application of compromise settlement either on the basis of (a) doubtful validity of the assessment or (b) financial incapacity of the taxpayer, whether the same was denied by or still pending with the Regional Evaluation Board (REB) or the National Evaluation Board (NEB), as the case may be, on or before the effectivity of these Regulations;

- Delinquent Withholding Tax liabilities arising from non-withholding of tax; and

- Delinquent Estate Tax liabilities.”

Q30: Can the estate still avail of the tax amnesty if the filer failed to submit

the validated APF with proof of payment to the concerned RDO within the two-year

availment period of tax amnesty?

A30: No. Failure to submit the validated APF with proof of payment within the two-year period from the effectivity of RR No. 6-2019 is tantamount to non-availment of the Estate Tax Amnesty. However, any payment made may be applied against the total regular estate tax due inclusive of penalties.Q31: The decedent died on December 20, 2017. The corresponding estate tax return

indicating estate tax due of P500,000.00 was filed on May 15, 2018 but only P350,000.00

was paid. Can the taxpayer avail of estate tax amnesty for the unpaid tax due?

A31: Yes, the filer can avail the tax amnesty on the difference between the net taxable estate per original declaration and net taxable estate applicable to the estate tax amount paid, computed using the applicable scheduled rates, as presented below:

Per Return Gross Estate 7,933,333.35 Less: Allowable Deductions Funeral Expense 200,000.00 Medical Expense 500,000.00 Family Home 1,000,000.00 2,700,000.00 Standard Deduction 1,000,000.00 5,233,333.35 Total Net Estate 0.00 Less: Share of Surviving Spouse (assuming none) 5,233,333.35 Net Taxable Estate (with estate tax due of P500,000.00) Net Taxable Estate applicable to the paid P350,000.00

Taxable Estate:

Applicable to P135,000.002,000,000.00 Applicable to Excess

(P350,000-P135,00)/11%1,954,545.45 3,954,545.45 3,954,545.45 Net Taxable Estate subject to tax amnesty 1,278,787.90 Estate Tax Amnesty Due (6%) 76,727.27 The ETAR shall be filed in the same RDO where the estate tax return was filed and the following documents shall be presented:

- Copy of Estate Tax Return previously filed; and

- Certificate of Payment from the RDO if available, otherwise, secure from Revenue Accounting Division (RAD) in the National Office.

Q32: Using the same facts on Q31, after the taxpayer paid the estate tax amnesty

amounting to P76,727.27 as computed, it was later on discovered that a certain real

property owned by the decedent with FMV per tax declaration of P1,500,000.00

and ZV of P1,000,000.00 (no improvement) was not declared in the previously filed

ETAR. Can the taxpayer still avail of the estate amnesty on the undeclared

property and what would be the estate tax amnesty amount?

A32: Yes, the estate tax amnesty due is 6% of P1,500,000.00, which is the higher value between FMV and ZV of the undeclared real property.Q33: If the undeclared property on Q32 is a conjugal property, how much is the

estate tax amnesty amount?

A33: The estate tax amnesty amount shall be computed as follows:

FMV of the property 1,500,000.00 Less: Share of surviving spouse 750,000.00 Net undeclared property 750,000.00 Multiply by 6% Estate Tax Amnesty Amount Due 45,000.00 Q34: Will the withdrawal from the bank of the estate be allowed after presentation

of the Certificate of Availment only?

A34: No. Withdrawal can only be allowed upon presentation of the eCAR, except when a written request allowing partial or total withdrawal of cash of the taxpayer was approved by the Commissioner or the Revenue District Officer.Q35: What document will be submitted in case there is no death certificate issued

by the Philippine Statistics Authority (PSA)?

A35: The Certificate of No Record of Death from PSA and any valid secondary evidence including but not limited to those issued by any government agency/office sufficient to establish the fact of death of the decedent may be submitted.Q36: Can the filer avail of the estate tax amnesty if there is an on-going investigation

on estate tax liabilities?

A36: Yes, since there in no estate tax due that is considered delinquent.Q37: Can the taxpayer avail of the estate tax amnesty on the estate tax deficiency

resulting from post review made by the Assessment Division?

A37: Yes, the taxpayer can avail of the estate tax amnesty.Q38: Formal Assessment Notice (FAN) covering deficiency estate tax was issued

against the estate of X who died on December 31, 2017. Within thirty (30) days

from receipt of the FAN, the heirs of X filed a valid protest. Can the heirs of X

avail of the estate tax amnesty?

A38: Yes, the heirs can avail of the estate tax amnesty since the deficiency estate tax assessment is not yet considered delinquent.Q39: Can the holder/buyer in a deed of sale transaction avail of the estate tax

amnesty on behalf of the heirs?

A39: Yes, provided that the holder/buyer shall present the notarized EJS signed by all heirs together with complete documentary requirements.Q40: Will the voluntary payment made under Payment Form No. 0605, supposedly

for estate tax amnesty, prior to the effectivity of RR No. 6-2019 be considered as valid

payment for amnesty?

A40: No, because at the time of payment, the estate tax amnesty is not yet effective. Moreover, the proper form for amnesty payment is BIR Form No. 0621-EA – APF which must be duly approved and endorsed by the concerned Revenue District Officer.The voluntary payment in this case may be claimed for refund subject to existing rules and regulations on refund.Source: RMC 68-2019

Estate tax

Estate Tax, according to BIR is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition.

To make it simpler, the Estate Tax is the tax paid by the heirs, in order for them to transfer the properties owned by the deceased person to themselves.

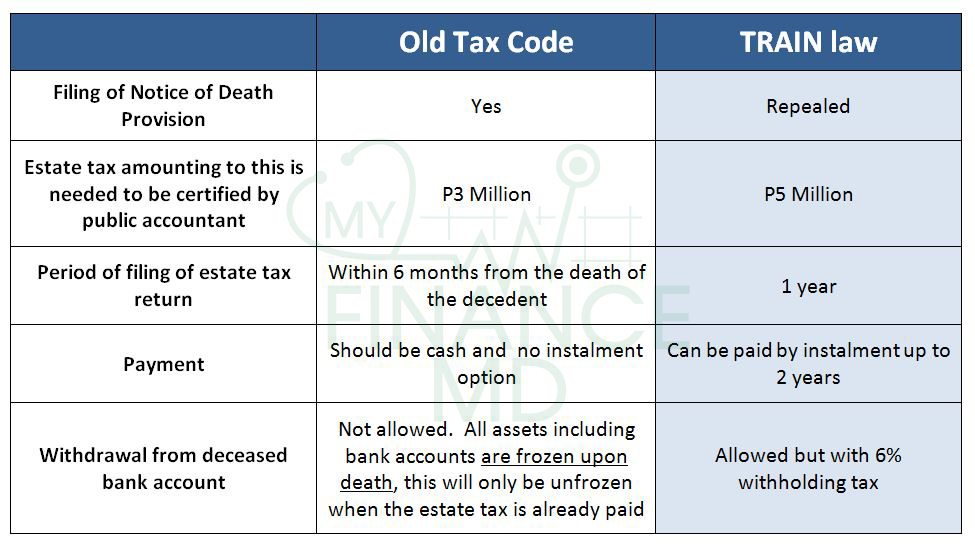

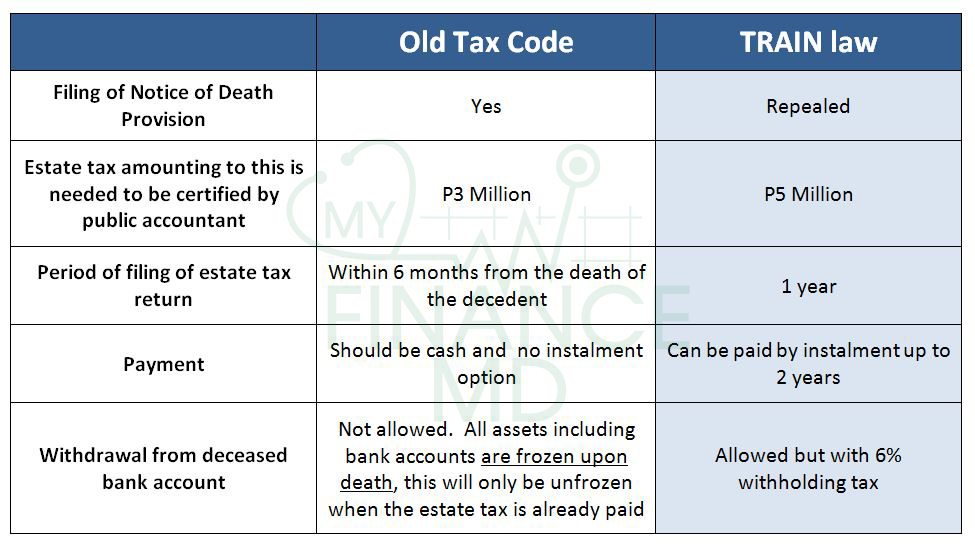

The previous laws governing Estate Tax is complicated since the tax schedules are computed with different rates and it is also quite pricey because it will start at 200,000 net estates. Now, instead of having a complicated tax schedule, the TRAIN reduces and restructures the Estate Tax to a low flat rate of 6% on the net value of the estate.

Let’s see the major changes in our Estate Tax laws:

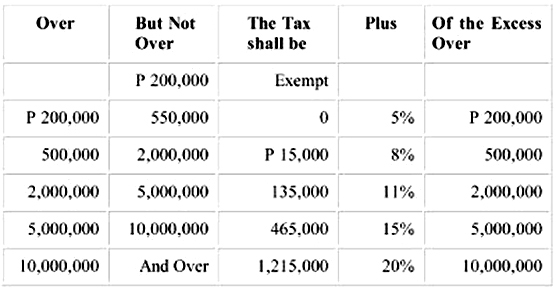

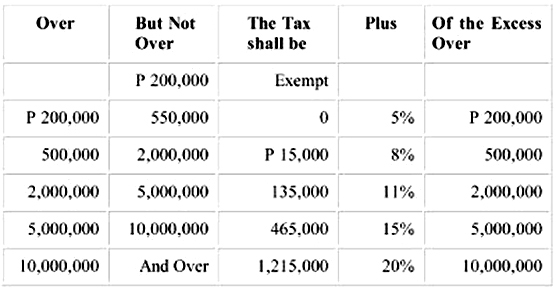

1. Changes in the graduated rates to flat 6%. Previously, the computation of the Estate Tax is on the value of the net estate of the decedent. Computed based on tax schedule from P200,000 onwards.

This was the previous tax rates:

This was the previous tax rates:

Now it will be subject to a flat rate of 6%.

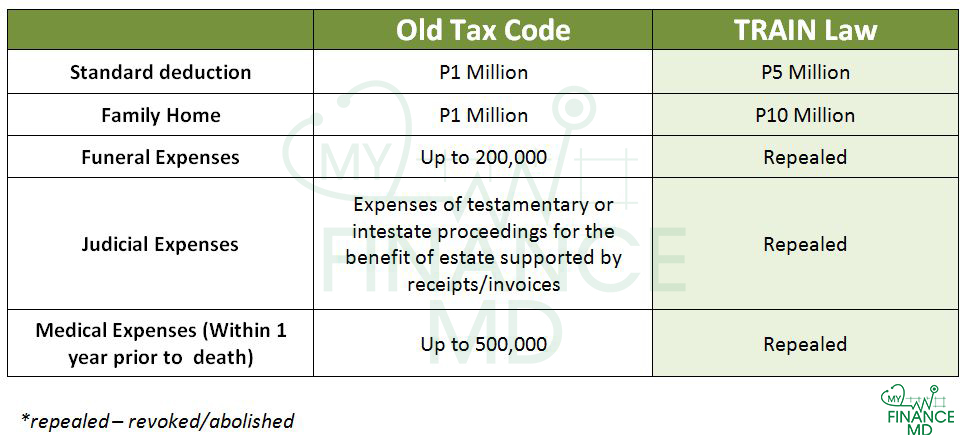

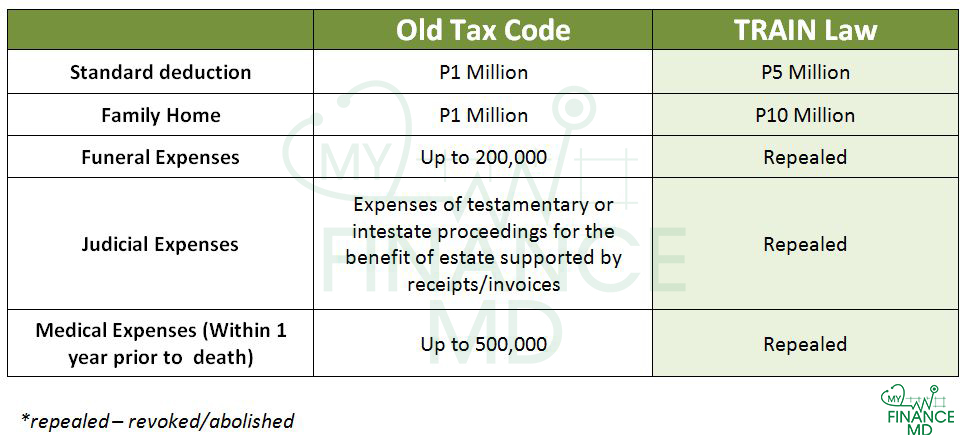

2. Allowable deductions where increase as follows:

Even if the funeral, judicial and medical expenses deductions were repealed, for me its ok since the standard deduction was raised from P1 Million to P5 Million.

3. Other administrative changes

To make you fully understand how significant the changes are, let me tell you the story of Mr. Mayaman.

Mr. Mayaman, a 70-year-old businessman, single, died of Myocardial Infarction or heart attack. He left a good amount of estate and his siblings will be his heirs. How much would be the Estate Tax to be paid by his heirs comparing the old tax laws and under the new train law?His gross estate is as follows:Php13M Family HomePhp3M business propertiesPhp3M Shares of stocksPhp2M Other Assets

Before dying he incurred Php 1M worth of medical expenses. During burial, the expenses of the heirs are about Php1 Million.

Mr. Mayaman’s Estate Tax Liability under the old Tax code:

Total Gross Estate: Php13M Family Home + Php3M business properties + Php3M Shares of stocks + Php2M Other Assets = Php21 Million

Net Estate: Gross Asset minus Allowable deductions

Php21 Million (less) Php 1M Standard Deduction (less) Php 1M from Family Home (less) 500,000 Medical expenses (less) funeral expenses 200,000 (less) Judicial expenses 300,000

Total Taxable Net Estate = Php 18M

Refer to the old tax table above.

If the value of the net estate is Php18 million, the estate shall pay Php1,215,000. An additional Php1.6 Million shall be imposed, which is the 20% of the excess of P10 million.

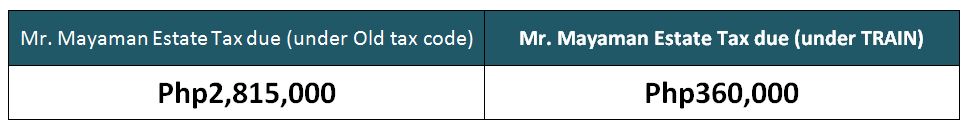

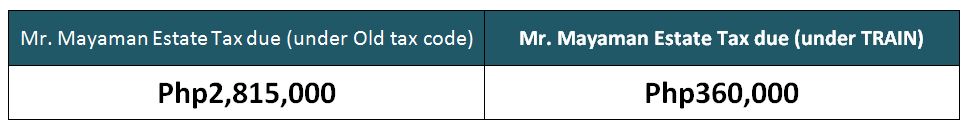

The total amount of Estate Tax to be paid would be Php2,815,000.

Mr. Mayaman’s Estate Tax Liability under the TRAIN law:

Total Gross Estate: Php13M Family Home + Php3M business properties + Php3M Shares of stocks + Php2M Other Assets = Php21 Million

Net Estate: Gross Asset minus Allowable deduction

Php21 Million (less) Php 10M from Family Home (less) Php5 M Standard Deduction

Total Taxable Net Estate = Php6 Million

Under the TRAIN law, from the old estate tax table, it is now computed with 6% flat rate. Thus, 6% of the Php6 million estate is Php360,000.

You see, instead of having a complicated tax schedule, the TRAIN reduces and restructures the estate tax to a low flat rate of 6% on the net value of the estate. It is simpler and definitely – way CHEAPER!

Before, Kim Henares set an ambitious target of Php 50 Billion collected on estate taxes using strong-arm tactics, with little success since the collection average was only P12.5 Billion per year.

Now, Finance Secretary Carlos G. Dominguez’s scheme hopes to encourage compliance by making it cheaper and simpler.

He said, “A lot of people don’t pay (estate taxes) because they don’t like to pay for the transfer of the land, a lot of lands is still in the name of grandfathers, so it’s locked up.”

If people are encouraged to pay cheaper price, it will also encourage the development of idle properties, thus, economic activity and development.

Do you think we have a better Estate Tax under TRAIN? For me, definitely yes. Cheaper and Simpler. But wait, there’s more! If you think this is good enough, it will even get better soon.

For the next TRAIN, the department is looking at an Estate Tax Amnesty for all Estate Tax dues to offer a clean slate to those who have not yet paid their dues and accumulated surcharges, excluding those with filled cases in courts. Let’s see if this will be implemented soon since they are eyeing on this to be implemented this 2018.

Subscribe to:

Posts (Atom)