Estate Tax, according to BIR is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition.

To make it simpler, the Estate Tax is the tax paid by the heirs, in order for them to transfer the properties owned by the deceased person to themselves.

The previous laws governing Estate Tax is complicated since the tax schedules are computed with different rates and it is also quite pricey because it will start at 200,000 net estates. Now, instead of having a complicated tax schedule, the TRAIN reduces and restructures the Estate Tax to a low flat rate of 6% on the net value of the estate.

Let’s see the major changes in our Estate Tax laws:

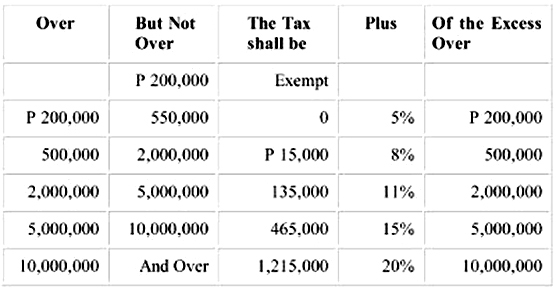

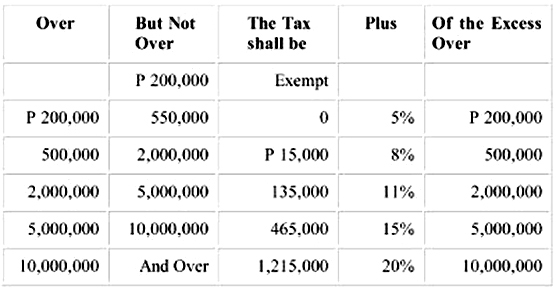

1. Changes in the graduated rates to flat 6%. Previously, the computation of the Estate Tax is on the value of the net estate of the decedent. Computed based on tax schedule from P200,000 onwards.

This was the previous tax rates:

This was the previous tax rates:

Now it will be subject to a flat rate of 6%.

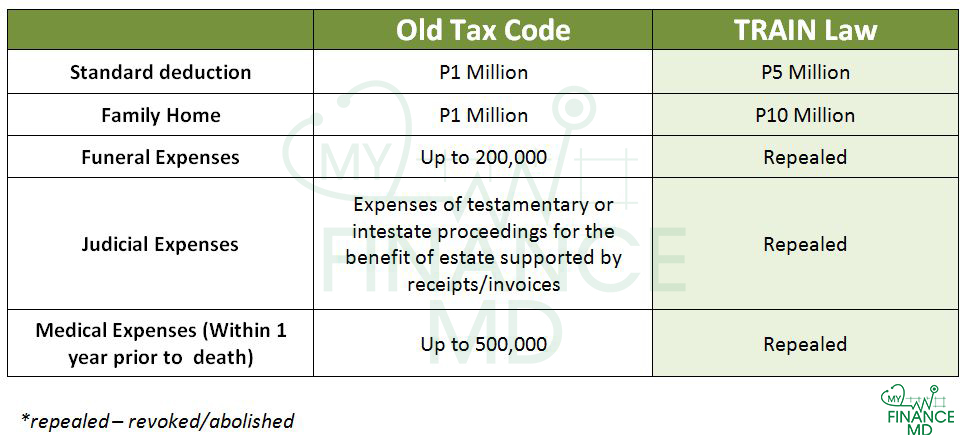

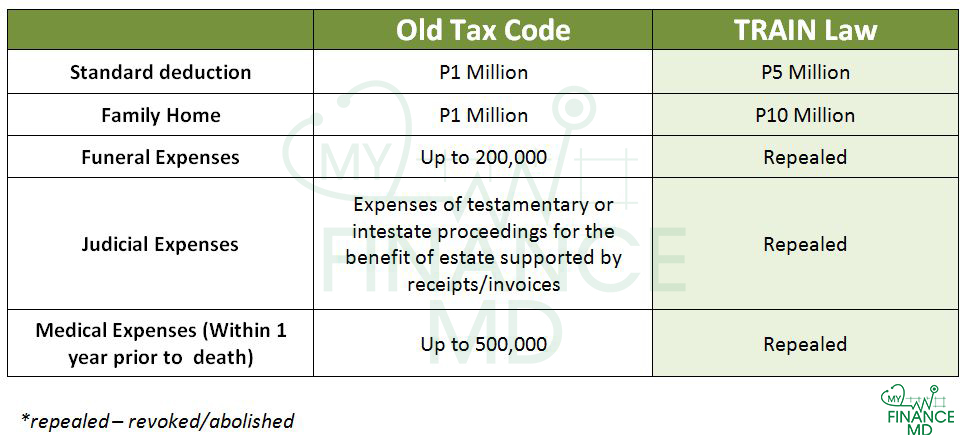

2. Allowable deductions where increase as follows:

Even if the funeral, judicial and medical expenses deductions were repealed, for me its ok since the standard deduction was raised from P1 Million to P5 Million.

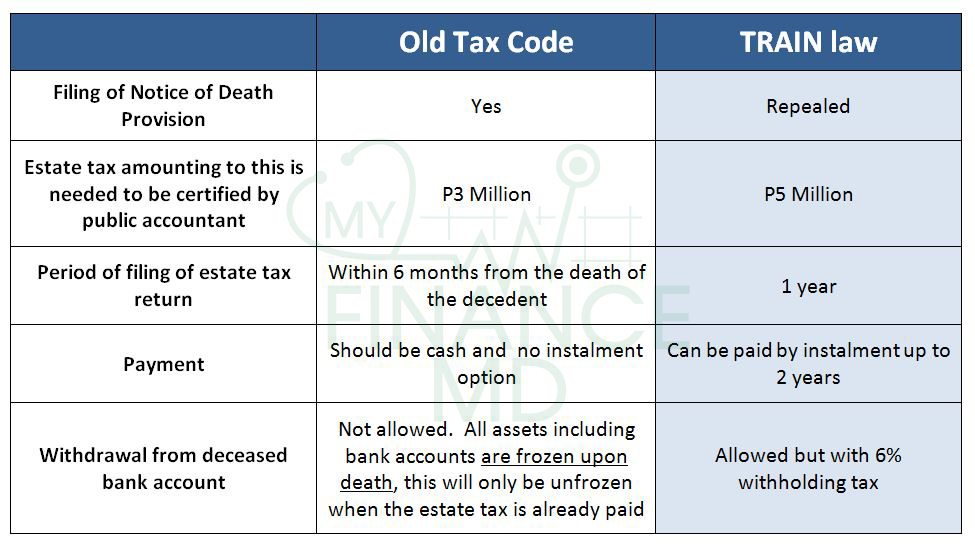

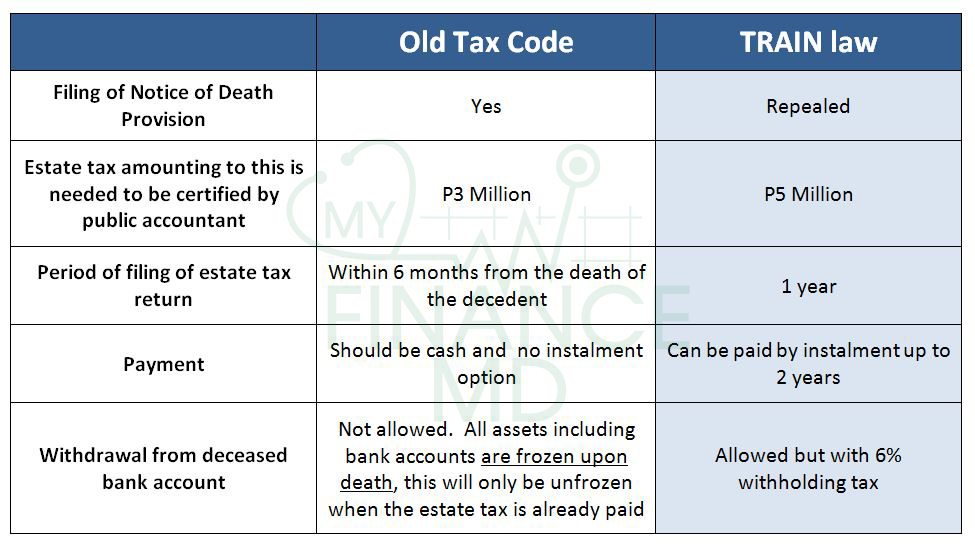

3. Other administrative changes

To make you fully understand how significant the changes are, let me tell you the story of Mr. Mayaman.

Mr. Mayaman, a 70-year-old businessman, single, died of Myocardial Infarction or heart attack. He left a good amount of estate and his siblings will be his heirs. How much would be the Estate Tax to be paid by his heirs comparing the old tax laws and under the new train law?His gross estate is as follows:Php13M Family HomePhp3M business propertiesPhp3M Shares of stocksPhp2M Other Assets

Before dying he incurred Php 1M worth of medical expenses. During burial, the expenses of the heirs are about Php1 Million.

Mr. Mayaman’s Estate Tax Liability under the old Tax code:

Total Gross Estate: Php13M Family Home + Php3M business properties + Php3M Shares of stocks + Php2M Other Assets = Php21 Million

Net Estate: Gross Asset minus Allowable deductions

Php21 Million (less) Php 1M Standard Deduction (less) Php 1M from Family Home (less) 500,000 Medical expenses (less) funeral expenses 200,000 (less) Judicial expenses 300,000

Total Taxable Net Estate = Php 18M

Refer to the old tax table above.

If the value of the net estate is Php18 million, the estate shall pay Php1,215,000. An additional Php1.6 Million shall be imposed, which is the 20% of the excess of P10 million.

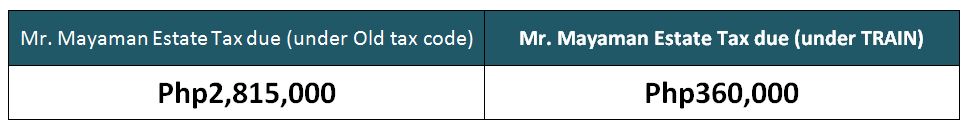

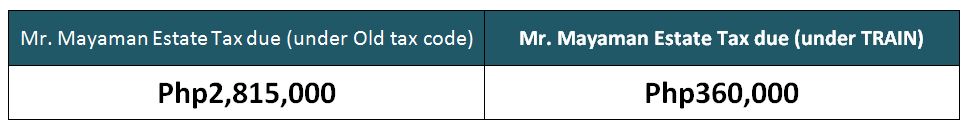

The total amount of Estate Tax to be paid would be Php2,815,000.

Mr. Mayaman’s Estate Tax Liability under the TRAIN law:

Total Gross Estate: Php13M Family Home + Php3M business properties + Php3M Shares of stocks + Php2M Other Assets = Php21 Million

Net Estate: Gross Asset minus Allowable deduction

Php21 Million (less) Php 10M from Family Home (less) Php5 M Standard Deduction

Total Taxable Net Estate = Php6 Million

Under the TRAIN law, from the old estate tax table, it is now computed with 6% flat rate. Thus, 6% of the Php6 million estate is Php360,000.

You see, instead of having a complicated tax schedule, the TRAIN reduces and restructures the estate tax to a low flat rate of 6% on the net value of the estate. It is simpler and definitely – way CHEAPER!

Before, Kim Henares set an ambitious target of Php 50 Billion collected on estate taxes using strong-arm tactics, with little success since the collection average was only P12.5 Billion per year.

Now, Finance Secretary Carlos G. Dominguez’s scheme hopes to encourage compliance by making it cheaper and simpler.

He said, “A lot of people don’t pay (estate taxes) because they don’t like to pay for the transfer of the land, a lot of lands is still in the name of grandfathers, so it’s locked up.”

If people are encouraged to pay cheaper price, it will also encourage the development of idle properties, thus, economic activity and development.

Do you think we have a better Estate Tax under TRAIN? For me, definitely yes. Cheaper and Simpler. But wait, there’s more! If you think this is good enough, it will even get better soon.

For the next TRAIN, the department is looking at an Estate Tax Amnesty for all Estate Tax dues to offer a clean slate to those who have not yet paid their dues and accumulated surcharges, excluding those with filled cases in courts. Let’s see if this will be implemented soon since they are eyeing on this to be implemented this 2018.

No comments:

Post a Comment